Net Present Value Method

Net Present Value (NPV) is a financial modelling method for forecasting the value that would be added if an organisation delivers a project and exploits its benefits. It is based on estimating project-related cash flows during a timespan covering both the project's delivery and benefits realisation periods. If the project has significant disposal costs, the timespan should also include the disposal period. The project timespan is divided into time periods (usually years), with the net cash flow being calculated during each period.

- Benefits are modelled as being positive cash flows.

- Costs are modelled as being negative cash flows.

- The Net cash flow for each time period is calculated by subtracting the costs from the benefits.

NPV superimposes a discounting approach on this calculation to reflect the fact that any sum of cash in the future is worth less than the same amount of cash today. Today's value of a sum of cash now or at any time in the future is its present value. If we know the cost of tying up cash, we can calculate the present value of cash at different points in the future. This rate of cost determines the discount rate (D). When an appropriate discount rate has been identified, we can calculate the factor by cash flows within each time period in the model should be discounted i.e. the discount factors.

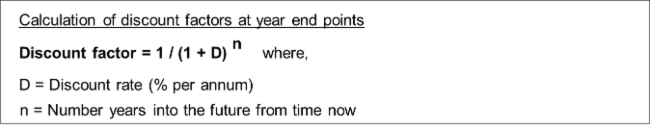

If discount factors are calculated at year end points, the formula for calculating discount factors is shown in the box below. (This is the formula described by most financial text books, although many use the symbol r rather than D for the discount rate).

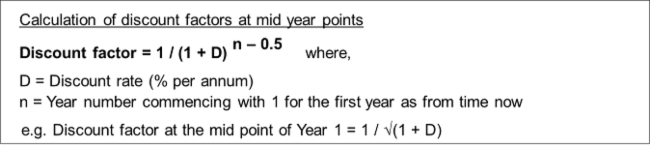

However, during the lifespan of project, cash flows tend to occur continuously through each year. Since the average point in time over which cash flows are experienced during each year tends towards the year mid point, calculating discount factors at these points often represents the effect of discounting more accurately. The formula for calculating discount factors at mid-year points is shown in the box below.

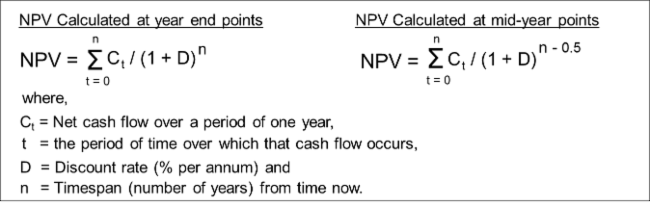

A project's NPV is calculated by multiplying the forecasts cash flow for each period with the relevant discount factor and then summing these calculations. The general NPV formula is thus:

Notes

- This link provides a simple example of an NPV model illustrating the method.

- This link illustrates how discount factors can be calculated in an Excel sheet.

- An NPV model can be divided into periods of greater than or less than one year. For example, periods of less than one year might be justified if the discount rate is particularly high or if the cash flow profile is lumpy. Significant one off cash flows might justify discount factors to be calculated in their own right.

- As with any financial modelling technique, there are always limits to the accuracy of forecasting that can be achieved. The following links provide information on the limitations of the NPV method, the selection of discount rates and good modelling practices.