NPV Models - Treatment of Inflation

Inflation must be treated in a consistent manner in any NPV model. There is a choice between two approaches. Either:

- costs and benefits are estimated at constant (today's) cost and the discount rate calculated net of inflation, or

- the effects of inflation on costs and benefits are included in the model and the discount rate determined using nominal rates.

It should be noted that some methods for calculating discount rates include inflation, whereas others do not. For example, the weighted average cost of capital (WACC) is calculated at nominal rates and therefore includes inflation, whereas the UK Treasury Green Book uses a social time preference rate (STPR) and calculates its discount rate in real terms.

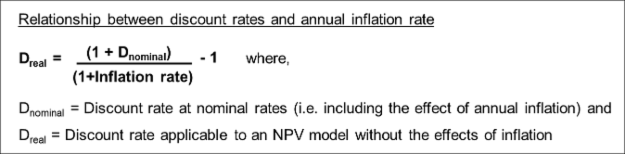

If the given discount rate is inconsistent with the treatment of inflation in a model's estimates it can be adjusted to suit. For example, if the discount rate is derived from a WACC calculation, but the cost and benefits estimates are estimated at constant cost, the real rate equivalent discount factor can be calculated as shown in the box below.

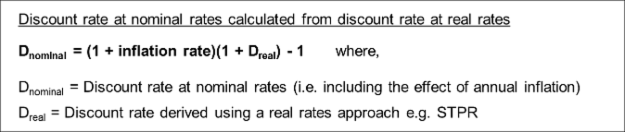

Similarly, if the model's estimates include the effects of inflation but the given discount rate is derived from an STPR calculation, the adjusted discount rate can be calculated as shown in the box below. (Note that the discount rate and inflation have a compound effect).

Including the effects of inflation in a model

In practice, it is easier for estimators to work at constant costs. Modelling mistakes may also be easier to spot when constant cost rates are used. The models used by this web site use constant cost estimates for the reason that it is easier to see the effect that other features of the models have. However, there are sometimes good reasons to include inflation. For example:

- Different cost types e.g. labour and materials may attract different inflation rates.

- If tax reliefs or credits are significant and offset from the timing of their associated costs or benefits, they would be affected by a rate of inflation associated with one period, but would need to be discounted at rate associated with another (later) period.

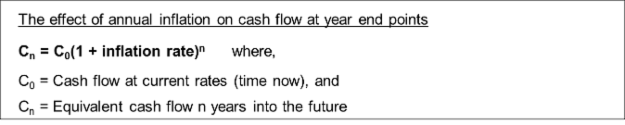

When inflation is included in project models, its effects are usually calculated with standard rates that represent the organisation's estimate of what inflation. These calculations are then used to transform estimates that have been made at today's rates. When modelling on this basis, it is important to recognises that inflation has a compound effect. Hence for a cost estimated at current rates, the equivalent cost n years into the future is calculated as shown in the box below.

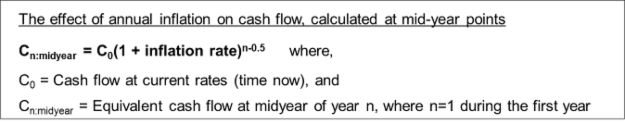

Care should be taken to ensure that there is consistency in the phasing of the effects of the discount rate and inflation. For example, if discount factors are calculated at mid-year points, the effect of inflation should be calculated on the equivalent basis. If Year 1 is the first full year that follows time now, the effect of inflation on cost during the mid-year of Year n should be calculated as shown in the box below.